What is Inflation?

does the president control inflation is defined as the rate at which the general level of prices for goods and services rises, eroding purchasing power. As inflation increases, each unit of currency buys fewer goods and services, consequently decreasing the value of money. In simpler terms, inflation signifies that money is losing its ability to purchase the same amount of goods it once could, which can have a profound effect on both consumers and the economy as a whole.

There are several factors that contribute to the occurrence of inflation. One significant factor is an excess of money circulating in the economy without a proportional increase in the production of goods. When people have more money to spend, but the supply of items remains constant or declines, demand outstrips supply, resulting in increased prices. Additionally, inflation can be influenced by rising costs of production, which often lead businesses to pass on these expenses to consumers through higher prices.

Typical examples of items that are often impacted by inflation include everyday necessities such as food, gasoline, and housing. For instance, if the cost of crude oil rises, consumers may notice an immediate increase in gas prices. Similarly, factors like housing demand can cause rents and property prices to escalate, while food prices may rise due to supply chain issues or increased agricultural costs. These examples illustrate how inflation can variably affect different sectors of the economy, impacting the overall financial well-being of individuals and families.

Understanding inflation is crucial for both consumers and policymakers. As prices rise, budgeting becomes more challenging, and strategic financial planning becomes imperative. Recognizing inflation’s causes and effects can aid individuals in making informed decisions about their financial futures.

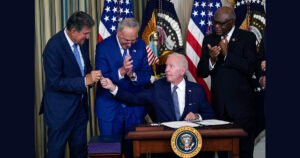

Does the President Control Inflation?

The president of a country plays a significant role in shaping economic policies, but it is essential to clarify that they do not have direct control over inflation. Inflation, defined as the general rise in prices over time, is influenced by a myriad of factors, including supply chain dynamics, monetary policy, and consumer behavior. While the president does not set prices or print money, their actions can impact the economy in ways that may contribute to inflationary pressures or help alleviate them.

One of the primary ways a president can influence inflation is through fiscal policy, particularly government spending and taxation. For instance, when a president enacts stimulus packages aimed at boosting economic growth, the increased government spending can lead to higher demand for goods and services. If this demand outpaces supply, inflation may rise. Conversely, measures such as tax increases or spending cuts can potentially reduce inflationary pressures by curbing demand.

Moreover, the president’s collaboration with the Federal Reserve is crucial in managing inflation. The Fed is responsible for the country’s monetary policy and has tools at its disposal to control inflation, including interest rate adjustments. While the president does not directly dictate these policies, their appointment of Federal Reserve board members and influence over economic discussions can steer monetary policy direction. A president advocating for low interest rates may promote borrowing and spending, which could further drive inflation.

Trade policies and international relations also play a role in inflation, as they can impact the cost of imports and the overall economic environment. Decisions regarding tariffs or trade agreements can influence domestic prices by altering supply and demand relationships. Therefore, while the president’s ability to directly control inflation is limited, their economic policies and leadership can have substantial implications in shaping inflationary trends and stabilizing the economy.

Who Really Controls Inflation?

Inflation is a multifaceted economic phenomenon influenced by various entities and factors. One of the primary bodies involved in managing inflation is the Federal Reserve, often referred to as the Fed. The Fed plays a crucial role in regulating interest rates, which in turn affects borrowing costs for consumers and businesses. When the Fed increases interest rates, it generally slows down economic activity, which can help in curbing inflation. Conversely, lowering interest rates can stimulate spending and investment, potentially leading to increased inflation. Through these monetary policy tools, the Federal Reserve aims to maintain price stability and moderate long-term interest rates.

Another key player is Congress, which holds significant sway over government spending and fiscal policy. Legislative decisions regarding taxation and public expenditure can substantially influence overall demand in the economy. For instance, increased government spending can lead to higher demand for goods and services, potentially driving up prices and contributing to inflation. Conversely, reducing government spending can suppress demand, helping to stabilize or lower inflation rates.

Businesses also have an essential role in determining prices based on market demand. Companies often adjust pricing strategies in relation to consumer behavior; if demand is high, businesses may raise prices, thereby contributing to inflation. Furthermore, consumer spending habits are integral to price fluctuations. As individuals increase their spending, it creates upward pressure on prices, especially in a booming economy.

Additionally, global events, such as natural disasters or geopolitical conflicts, can disrupt supply chains and influence inflation levels. Supply shocks can lead to shortages, resulting in higher prices. Thus, the interplay of these elements—monetary policy, fiscal policy, business strategies, consumer behavior, and external events—collectively shapes the intricate landscape of inflation control.

How Can the President Influence Inflation?

The President of the United States possesses several tools and measures to influence inflation within the economy. Understanding these can illuminate the delicate balance between fiscal policy, taxation, and economic stability. One of the primary avenues through which a president can steer inflationary trends is through policy setting. By proposing legislation that affects spending and investment, the president can stimulate or curb economic activity, thereby impacting inflation levels. For instance, increased government spending can boost demand, which may lead to higher prices if the economy is near or at full capacity.

Taxation also plays a crucial role in the president’s ability to influence inflation. By adjusting tax rates, the president can either encourage consumer spending and investment through tax cuts or slow down the economy through higher taxes. A reduction in taxes typically leaves consumers with more disposable income, thus potentially driving up demand and leading to inflation. Conversely, increased taxes can dampen spending, lending to a cooling effect on inflationary pressures.

Another significant factor is collaboration with the Federal Reserve. While the central bank operates independently, a president’s relationship with the Fed can lead to coordinated efforts to manage inflation. For instance, if inflation is rising, a president may advocate for higher interest rates, which the Fed can implement to moderate spending. Additionally, the president can promote production by supporting initiatives that enhance productivity, which also serves to mitigate inflation. Policies encouraging innovation, workforce development, and investments in infrastructure can contribute significantly to a more efficient economy.

Lastly, implementing energy policies can affect inflation, as energy costs are a critical component of overall price levels. A president advocating for sustainable energy sources or stabilizing fuel prices can directly influence inflation. By controlling energy prices, a president can help shield consumers from the often volatile nature of energy markets, thus impacting overall economic inflation.

Can a President Stop Inflation Quickly?

Addressing inflation is a complex challenge that cannot be resolved swiftly, despite the powers granted to a president. While a president can implement policies and propose measures aimed at curbing inflation, a comprehensive approach often takes time to manifest tangible outcomes. Factors contributing to inflation are multi-faceted, encompassing variables such as supply chain disruptions, energy prices, and broader economic conditions. Consequently, immediate solutions may not yield quick results and can require significant patience from both policymakers and the public.

One potential avenue for a president to influence inflation is through fiscal policy, which involves government spending and tax adjustments. By increasing or decreasing spending, a president can impact aggregate demand and, consequently, influence inflation rates. However, these policies usually require a lengthy legislative process and can face resistance from Congress. Even once enacted, the effects of such changes may take months, if not years, to permeate the economy fully.

Another route is the implementation of monetary policies, generally overseen by the Federal Reserve. Though a president may suggest certain directions for monetary policy, the Fed operates independently. As a result, any adjustments to interest rates or other monetary strategies may proceed according to economic assessments rather than political timelines. This disconnect highlights the limitations of presidential influence regarding inflation.

Moreover, new policies can inadvertently lead to unintended consequences. For example, measures aimed at controlling inflation may inhibit job growth or contribute to economic instability in other sectors. Thus, while the president has a role in addressing inflation, the execution of effective measures is inherently a lengthy and often unpredictable process, necessitating a thorough understanding of the economic landscape.

What Causes Inflation to Rise Fast?

Inflation, characterized by the general increase in prices and the subsequent decline in the purchasing power of money, can escalate rapidly due to several interconnected factors. One of the primary contributors to swift inflation is excessive government spending. When governments inject large amounts of money into the economy, particularly during times of crisis, this influx can lead to an oversupply of currency, which often results in rising prices for goods and services.

Additionally, low interest rates, typically implemented to stimulate economic growth, may inadvertently fuel inflation. Lower borrowing costs encourage consumer spending and investment, which can drive demand beyond the economy’s productive capacity, leading to price increases. In an environment where demand exceeds supply, inflationary pressure often intensifies.

Supply chain disruptions also play a critical role in rapid inflation. Events such as the COVID-19 pandemic have highlighted vulnerabilities in global supply chains, causing shortages of essential goods. When supply chains are interrupted, the reduced availability of products can lead to higher prices, as consumers compete for limited resources. This phenomenon is especially pronounced in sectors reliant on just-in-time inventory practices, which can exacerbate shortages and create significant price fluctuations.

Moreover, high energy costs can significantly impact inflation rates. Energy is a fundamental input for manufacturing, transportation, and heating, among other sectors. An increase in energy prices, often driven by geopolitical tensions or supply constraints, can create “cost-push” inflation, where the rising costs of production are passed on to consumers in the form of higher prices.

Lastly, labor shortages can contribute to rising inflation. A reduced workforce can lead to increased wages as employers compete for talent. While higher wages are beneficial for workers, they can also result in higher costs for businesses that may subsequently increase the prices of their products and services. Collectively, these factors illustrate the multi-faceted nature of inflation and its ability to escalate quickly under certain conditions.

How Does Inflation Affect Everyday People?

Inflation plays a significant role in shaping the financial landscape for individuals and households, altering their purchasing power and lifestyle choices. As prices for essential goods and services, such as food and gas, climb, consumers frequently find themselves grappling with tighter budgets. A modest inflation rate can gradually erode real incomes, making it increasingly difficult for families to afford necessities.

Recent data illustrates that over the past year, the price of staple food items has surged by approximately 10%, hitting households directly in their wallets. This uptick in food costs can lead families to adjust their shopping habits, opting for cheaper brands or fewer items, ultimately affecting their nutritional choices. Similarly, fuel prices have experienced volatile fluctuations, leaving many individuals to reconsider their commuting patterns or reliance on personal vehicles. Rising gas prices not only impact direct expenditure but also contribute to overall inflation by increasing shipping costs for consumer goods.

Interest rates on loans, including mortgages and credit cards, are heavily influenced by inflation. Lenders often respond to sustained inflation by increasing interest rates, resulting in heightened borrowing costs for consumers. A higher interest rate environment can discourage individuals from pursuing significant investments like home purchases, which in turn affects the housing market. For renters, rental prices continue to rise, leading to increased housing costs, making it more challenging for individuals to secure affordable accommodations.

Ultimately, the impact of inflation extends beyond immediate financial pressures; it influences long-term savings as well. With inflation outpacing interest rates on savings accounts, the real value of savings diminishes over time, compelling individuals to reassess their financial strategies. This multifaceted effect of inflation underscores the necessity for people to remain vigilant about their financial planning and adapt to changing economic circumstances.

What Can People Do During Inflation?

Inflation can significantly impact the financial stability of individuals and families, leading to increased costs of living and diminished purchasing power. Therefore, it becomes crucial for people to adopt proactive financial strategies during inflationary periods. One of the first steps individuals can take is to establish a realistic budgeting plan. By tracking income and expenses meticulously, one can identify areas where spending can be reduced, allowing for the prioritization of essential needs over discretionary spending.

Another effective strategy is to focus on saving wisely. During times of inflation, maintaining an emergency fund that covers several months’ worth of expenses can be a lifesaver. This reserve acts as a financial buffer, providing peace of mind and a degree of stability while combating inflated prices. Moreover, comparing prices and seeking discounts can lead to substantial savings. Utilizing tools such as coupons, cashback offers, and sales promotions can assist in minimizing expenditures, ultimately preserving financial resources.

Reducing debt is also a vital action that individuals should consider. High-interest debt can exacerbate the challenges posed by inflation, as repayments become more burdensome. Prioritizing the payment of high-interest loans can relieve some financial pressure and free up funds for other essential expenses or savings. Additionally, exploring multiple sources of income could enhance financial resilience. This may involve side jobs, freelance work, or investments that could yield passive income, thereby diversifying one’s financial portfolio.

Incorporating these strategies not only helps individuals cope during inflation but also fosters an essential understanding of personal financial literacy. By staying informed and actively managing finances, individuals can better navigate the challenges of inflation, ultimately securing their financial future.

5 Small FAQs About Inflation and the President

1. Can the President directly control inflation?

No, the President cannot directly control inflation. Inflation is primarily influenced by various factors including supply chain disruptions, monetary policy, and global market conditions. While the President can propose economic policies and budgets, the actual control of inflation largely lies within the Federal Reserve’s jurisdiction, which manages the nation’s monetary policy.

2. What role does the President play in managing inflation?

The President plays a significant role in setting the economic agenda and influencing fiscal policy through legislation and budget proposals. By enacting policies aimed at enhancing economic growth and stability, the President can potentially impact inflation rates. Additionally, the appointment of Federal Reserve leaders and the administration’s stance on trade and fiscal matters can shape inflation indirectly.

3. How can presidential policies affect inflation?

Presidential policies can influence inflation through various mechanisms. For instance, increased government spending can stimulate demand, which may lead to higher prices. Conversely, policies aimed at reducing the deficit through fiscal restraint can help moderate inflation. Tax laws and tariffs can also alter supply dynamics, affecting price levels in the economy.

4. Does inflation rise during presidential elections?

Historically, inflation can fluctuate during election years due to increased government spending and consumer demand driven by campaign activities. However, these trends may not be universal and depend on existing economic conditions. It is crucial to analyze the broader economic environment rather than attributing inflation changes solely to electoral cycles.

5. Do Presidents use inflation as a tool for economic policy?

While Presidents may not use inflation as a direct tool, they can implement policies that aim either to mitigate or to stimulate inflation. For example, a President might advocate for policies that encourage consumer spending to keep inflation within a targeted range. However, the balance must be carefully managed to avoid runaway inflation or deflation, which can jeopardize economic stability.

Conclusion: Understanding the Complex Nature of Inflation

In examining the intricate relationship between presidential actions and the phenomenon of inflation, it is essential to recognize that while the president can exert influence on economic policies, they do not wield direct control over inflation rates. The multifaceted nature of inflation stems from various factors, including monetary policy decisions made by the Federal Reserve, global economic conditions, supply chain disruptions, and consumer behavior, among others. These dynamics create a complex environment where presidential policies can either mitigate or exacerbate inflation, but cannot single-handedly determine its trajectory.

Throughout this discussion, we have explored how presidential decisions regarding fiscal spending, tax policies, and regulatory frameworks can impact inflation indirectly. For instance, stimulus measures aimed at boosting economic activity may lead to increased demand, potentially contributing to inflationary pressures. Conversely, policies designed to cool down an overheated economy may help to stabilize prices. However, these outcomes depend significantly on external factors and the response of various economic agents.

Furthermore, it is crucial for individuals to understand the broader economic landscape to make informed financial decisions. Staying updated on the nuances of economic policies and their potential implications for inflation can empower consumers to navigate financial markets more wisely. As inflation remains a persistent economic concern, awareness of its multi-dimensional causes will also aid in preparing for potential surprises in price fluctuations.

In conclusion, grasping the complexities of inflation-related factors is vital for both policymakers and citizens. While the president can shape economic conditions, the interplay of countless variables means that inflation will always be a multifaceted challenge that requires diligent analysis and responsive strategies.